In the ever-evolving landscape of technology, three titans—NVIDIA, Meta Platforms, and Alphabet (Google)—stand at the forefront, each carving a unique path in the industry. These companies have shaped the digital world in profound ways, driving innovation, revolutionizing user experiences, and fundamentally changing how businesses and consumers interact with technology. While all three have historically delivered strong financial performance, their future growth trajectories diverge based on their strategic focus, technological advancements, and market positioning.

NVIDIA’s explosive rise has been fueled by artificial intelligence (AI), gaming, and data center applications, with its dominance in GPUs making it a critical player in AI computing. Meta, on the other hand, is betting heavily on the metaverse, augmented reality (AR), and artificial intelligence to diversify beyond its advertising-heavy business model. Alphabet remains deeply entrenched in digital advertising, AI-powered search, cloud computing, and emerging technologies such as quantum computing, making it one of the most diversified and resilient tech giants.

Looking ahead, investors and analysts are keenly watching how these companies navigate industry challenges, including increased regulatory scrutiny, geopolitical risks, and heightened competition. As AI adoption accelerates, cloud computing expands, and digital experiences evolve, each of these companies must execute their growth strategies effectively to sustain their leadership positions.

This analysis delves into their financial performances, strategic initiatives, operational structures, and future innovation plans to assess which company holds the most promising potential for investors.

Company Overviews

NVIDIA Corporation (NVDA)

NVIDIA is renowned for its leadership in graphics processing units (GPUs), which are pivotal in gaming, professional visualization, data centers, and automotive applications. The company's GPUs have become integral to artificial intelligence (AI) and machine learning tasks, positioning NVIDIA as a key player in the AI revolution.

Meta Platforms, Inc. (META)

Formerly known as Facebook, Meta Platforms operates leading social media platforms, including Facebook, Instagram, and WhatsApp. The company is venturing into the metaverse—a virtual reality space where users can interact within a computer-generated environment—signifying its commitment to long-term innovation.

Alphabet Inc. (GOOGL)

Alphabet, the parent company of Google, dominates the search engine market and has a diverse portfolio encompassing YouTube, Android, and Google Cloud. The company's investments in AI and cloud computing underscore its strategy to maintain and expand its technological leadership.

Financial Performance

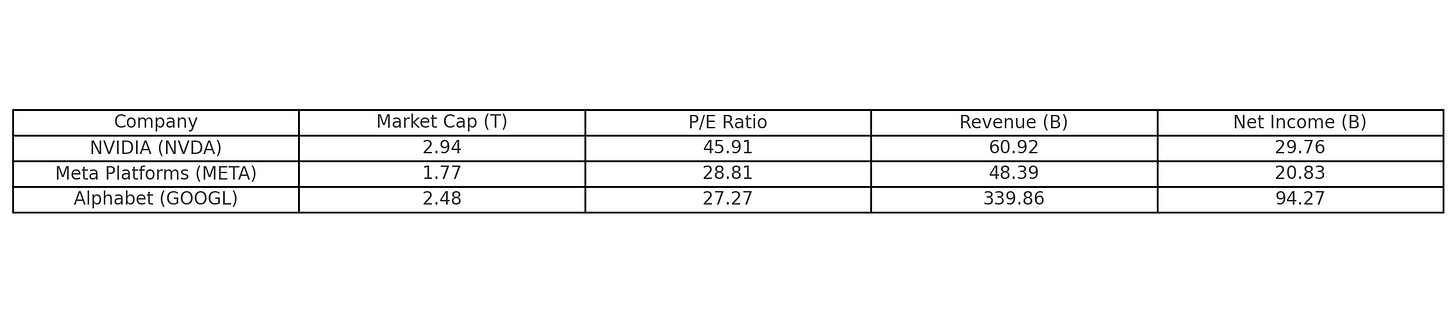

A comparative analysis of key financial metrics provides insight into each company's performance:

Operational Structure and Business Focus

NVIDIA

NVIDIA operates through two main business divisions: GPU computing and AI solutions. Its primary revenue comes from data center sales, gaming GPUs, and AI chips that power cloud computing. NVIDIA’s partnerships with cloud service providers and autonomous vehicle companies further its position as a technology enabler. The company is expanding into quantum computing and software-driven AI solutions to maintain its market leadership.

Meta Platforms

Meta’s core business relies on advertising revenue from social media platforms. However, the company is heavily investing in AI, augmented reality (AR), and virtual reality (VR). Meta’s Reality Labs division focuses on metaverse-related innovations, including the development of Oculus headsets and AR applications. The company is also integrating AI-driven content curation and recommendation algorithms to enhance user engagement and advertising efficiency.

Alphabet

Alphabet has a diverse business structure with three core focus areas: search and advertising, cloud computing, and AI innovation. Google’s search engine, YouTube, and ad network generate the bulk of revenue, while Google Cloud competes with AWS and Microsoft Azure. Alphabet is also heavily invested in AI research through its DeepMind subsidiary and is expanding into AI-generated search results and automated services.

Future Innovation and Growth Plans

NVIDIA

NVIDIA’s future growth revolves around AI acceleration, next-generation GPUs, and autonomous computing. The company is developing AI-powered computing platforms that go beyond traditional GPUs. With its Grace Hopper Superchip, NVIDIA aims to dominate AI and high-performance computing. It is also pushing advancements in self-driving vehicle technology, with partnerships in the autonomous vehicle sector expanding rapidly.

Beyond AI, NVIDIA is also working on new cloud computing solutions and expanding its data center business, aiming to become the backbone of AI-driven enterprises. This transition positions NVIDIA as a key enabler of AI infrastructure globally.

Meta Platforms

Meta is doubling down on the metaverse and AI-driven content. The company’s investment in AR/VR through Meta Quest and Horizon Worlds is its bet on next-generation digital interaction. Additionally, Meta is enhancing its AI recommendation engine to improve user engagement across its platforms, increasing advertising revenue potential.

Meta’s push into AI extends to generative AI models designed to enhance digital advertising, content creation, and customer interactions. Its goal is to maintain engagement across its ecosystem while growing revenue through AI-enhanced advertising strategies.

Alphabet

Alphabet is focusing on AI search evolution, cloud expansion, and quantum computing. Google’s AI-powered search is evolving with generative AI technology integrated into search queries. Google Cloud is also expanding its enterprise AI offerings, including AI-driven automation tools. The company is investing in quantum computing breakthroughs, which could revolutionize computing power for AI and machine learning applications.

Alphabet’s AI strategy includes integrating AI into all its major platforms, from Google Ads to YouTube, to optimize revenue and enhance user experience. Its investment in Waymo (self-driving technology) and Google DeepMind (AI research) suggests it is preparing for a more AI-dominant future.

Risk Factors

NVIDIA

The emergence of competitors like DeepSeek, which offer cost-effective AI solutions, could erode NVIDIA's market share. Additionally, reliance on hardware sales exposes the company to cyclical demand fluctuations.

Meta Platforms

Meta's substantial investment in the metaverse is speculative, with uncertain consumer adoption rates. The company also faces regulatory challenges and evolving user privacy expectations, which could impact its core advertising business.

Alphabet

Alphabet confronts regulatory scrutiny concerning its market dominance and data privacy practices. Intensifying competition in digital advertising and cloud services may pressure profit margins.

Conclusion

Each of these tech giants presents unique strengths and growth prospects:

NVIDIA is poised to benefit from the AI and machine learning boom but must navigate emerging competition.

Meta Platforms is innovating with its metaverse initiative, aiming to diversify its revenue base, though this path carries inherent uncertainties.

Alphabet maintains a stronghold in search and advertising while strategically investing in AI and cloud services to drive future growth.

Considering current market dynamics and financial metrics, Alphabet (GOOGL) appears to offer a balanced blend of stability and growth potential. Its diversified revenue streams, coupled with strategic investments in emerging technologies, position it favorably for sustained performance.

Investors should conduct thorough due diligence, considering individual risk tolerance and investment horizons, before making investment decisions.